All Categories

Featured

2 people purchase joint annuities, which offer a guaranteed earnings stream for the remainder of their lives. When an annuitant dies, the interest earned on the annuity is dealt with in a different way depending on the kind of annuity. A type of annuity that stops all repayments upon the annuitant's fatality is a life-only annuity.

If an annuity's designated recipient dies, the result depends on the particular terms of the annuity contract. If no such recipients are marked or if they, as well

have passed away, the annuity's benefits typically advantages usually go back annuity owner's proprietor. If a recipient is not named for annuity advantages, the annuity continues generally go to the annuitant's estate. Fixed income annuities.

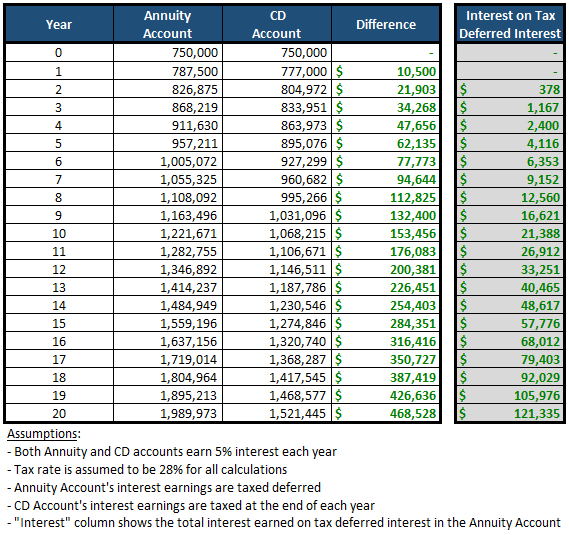

Taxation of inherited Deferred Annuities

Whatever section of the annuity's principal was not currently strained and any type of incomes the annuity accumulated are taxable as income for the recipient. If you inherit a non-qualified annuity, you will only owe tax obligations on the earnings of the annuity, not the principal made use of to acquire it. Because you're obtaining the entire annuity at when, you have to pay tax obligations on the whole annuity in that tax year.

Latest Posts

Analyzing Annuities Variable Vs Fixed A Comprehensive Guide to Investment Choices Defining Annuities Variable Vs Fixed Pros and Cons of Various Financial Options Why Choosing the Right Financial Strat

Breaking Down Your Investment Choices Key Insights on Your Financial Future What Is the Best Retirement Option? Pros and Cons of Annuities Variable Vs Fixed Why Fixed Index Annuity Vs Variable Annuity

Decoding Fixed Annuity Vs Equity-linked Variable Annuity Key Insights on Fixed Annuity Or Variable Annuity Breaking Down the Basics of Fixed Income Annuity Vs Variable Growth Annuity Features of Index

More

Latest Posts